Applying to KAUST - Your Complete Guide for Masters & Ph.D. Programs (Upcoming Admissions)

Admissions Overview & Key Requirements

If Congress does not provide additional funding to the Federal Student Aid account by September 30, the Pell Grant program is projected to face an $11.5 billion shortfall in fiscal year 2027, following a $5.5 billion gap in 2026. According to the Congressional Budget Office (CBO) 10-year projection, the cumulative deficit could reach $132 billion by 2036 if funding does not keep pace with inflation.

The Pell Grant program helps more than seven million low-income students pay for college. The shortfall could lead to reductions in the maximum award, limits on the number of semesters students can use the grant, or other eligibility changes. The last time Pell faced a shortfall, Congress limited grant eligibility for the summer term, which was later restored in 2017.

Student enrollment and program costs are rising rapidly: 6.4 million students received Pell Grants in the 2020–21 academic year, and approximately 7.6 million are expected to receive them this year. Following the expansion under the FAFSA Simplification Act starting in 2024, an additional 1.5 million students are now eligible for the maximum Pell Grant. In addition, students in short-term workforce training programs will also be able to use Pell Grants, further increasing program costs.

Experts warn that the shortfall cannot be addressed through temporary funding fixes alone. To sustain the Pell program, Congress must make serious financial decisions, both reducing costs and providing additional funds. The additional costs of the Workforce Pell program could further complicate the situation.

Pell Grants have always enjoyed bipartisan support and remain a critical source of aid for low-income students, prompting experts and advocates to call on lawmakers to protect the program.

Share

Applying to KAUST - Your Complete Guide for Masters & Ph.D. Programs (Upcoming Admissions)

Admissions Overview & Key Requirements

An mRNA cancer vaccine may offer long-term protection

A small clinical trial suggests the treatment could help keep pancreatic cancer from returning

Registration Opens for SAF 2025: International STEAM Azerbaijan Festival Welcomes Global Youth

The International STEAM Azerbaijan Festival (SAF) has officially opened registration for its 2025 edition!

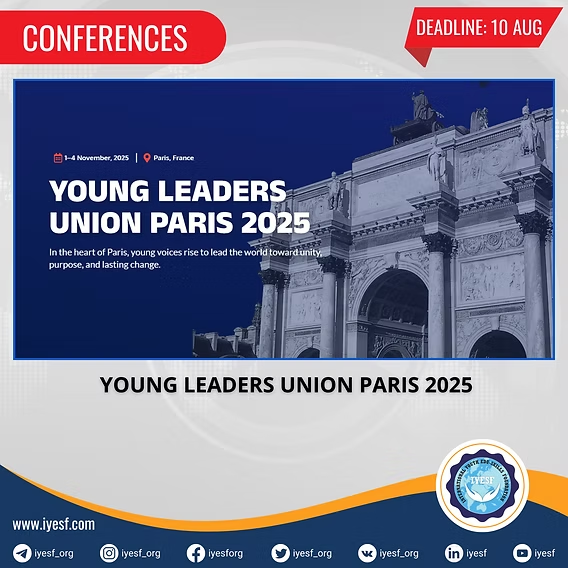

Young Leaders Union Conference 2025 in Paris (Fully Funded)

Join Global Changemakers in Paris! Fully Funded International Conference for Students, Professionals, and Social Leaders from All Nationalities and Fields

Yer yürəsinin daxili nüvəsində struktur dəyişiklikləri aşkar edilib

bu nəzəriyyənin doğru olmadığı məlum olub. Seismik dalğalar vasitəsilə aparılan tədqiqatda daxili nüvənin səthindəki dəyişikliklərə dair qeyri-adi məlumatlar əldə edilib.

Lester B Pearson Scholarship 2026 in Canada (Fully Funded)

Applications are now open for the Lester B Pearson Scholarship 2026 at the University of Toronto!